Tax Law Advisory

Criminal Liability In Respect To Taxes In Kenya

Recent months have seen a sustained increase of instances whereby both companies and their respective directors have been charged with tax offences before various courts....

Recent months have seen a sustained increase of instances whereby both companies and their respective directors have been charged with tax offences before various courts....

Landlords in Kenya are required to account for tax on rental income either on monthly basis or annually depending on the nature of the rental income received....

The High Court of Kenya issued a ruling on 19th April 2021 granting conservatory orders restraining the Kenya Revenue Authority (KRA) from implementing and enforcing the minimum tax provisions pending...

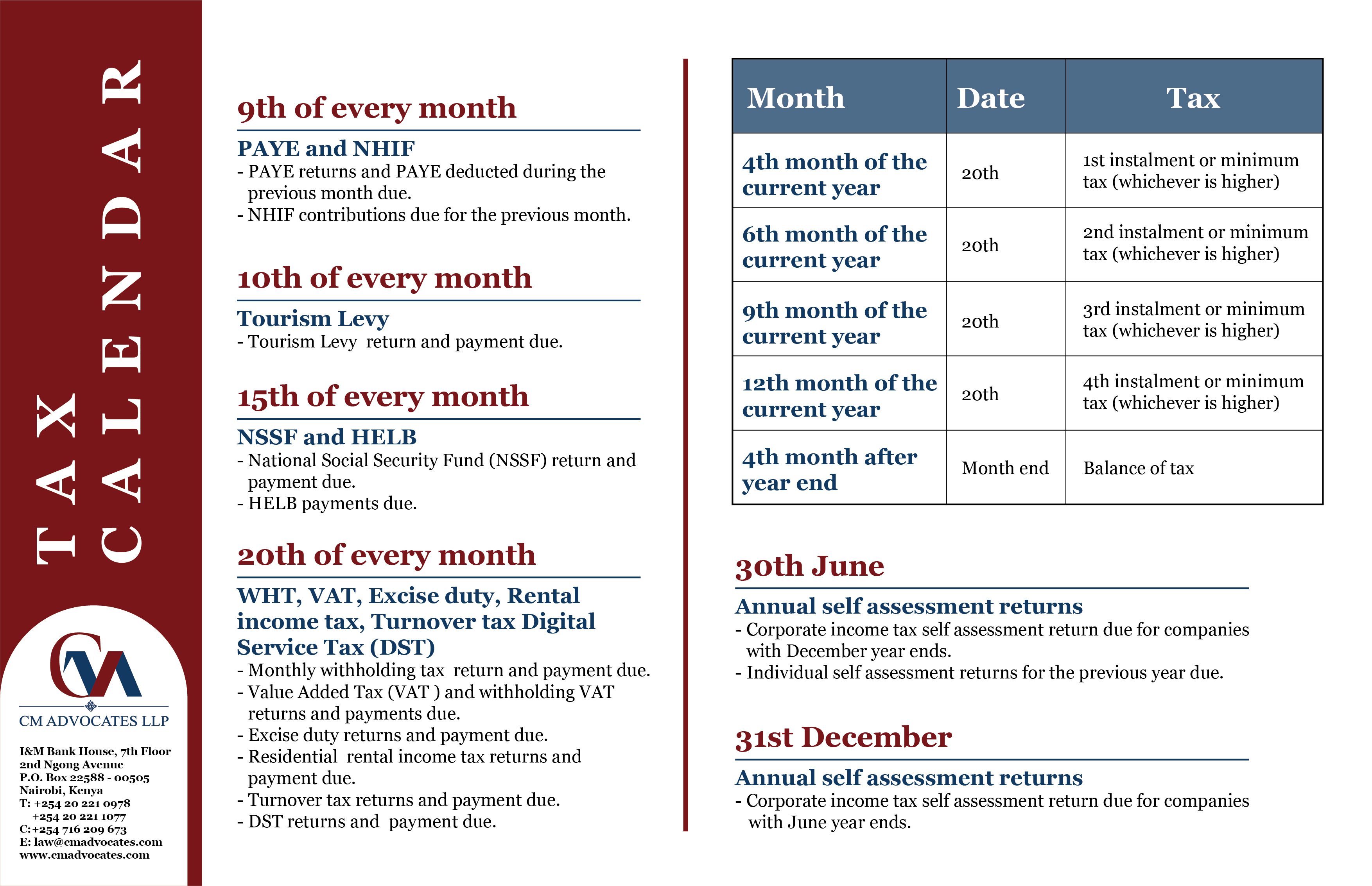

Installment tax is advance tax which is payable during the year of income. This is done before the accounts are done and finalized at year end in order to establish the actual tax payable....

The Kenya Revenue Authority (KRA) has a reward scheme for informants that successfully report a case of tax fraud or tax evasion....

The Voluntary Tax Disclosure Program (VTDP) is where a taxpayer confidentially discloses any tax liabilities to the Kenya Revenue Authority (KRA) for the purpose of being granted relief of penalties a...

The Voluntary Tax Disclosure Programme (VTDP) was introduced through the Finance Act, 2020 and seeks to grant relief on penalties and interest on any tax liability disclosed in respect to the period b...

Do you know that for most companies, the first minimum tax payment is due next month in April? Minimum Tax was introduced by the Finance Act 2020 with effect from 1st January 2021. The aim is to ensu...

For further information or assistance on the above kindly email us via tax@cmadvocates.com. ...

Skip to contentHomeAbout UsInsightsServicesContactAccessibility