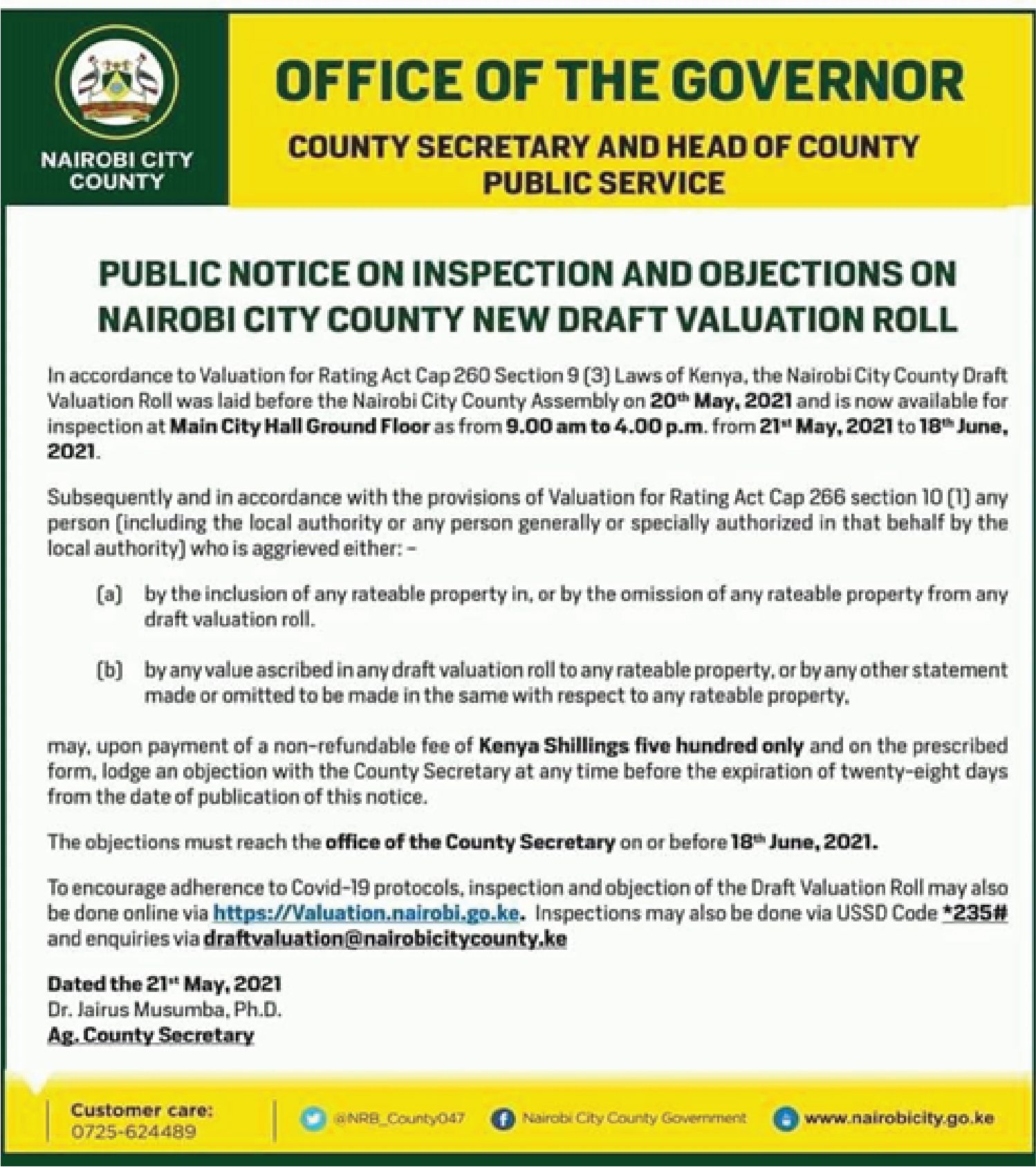

The Nairobi City County has announced the New County Draft Valuation Roll for public scrutiny.

The New Nairobi City County Draft Valuation Roll is available for inspection at the Main City Hall Ground Floor from 9.00 am to 4.00 pm until 18th June 2021.

Right to lodge an objection (when and how)

Persons aggrieved by the inclusion, omission of any ratable property from the draft valuation roll, or by any values ascribed in the roll with respect to any ratable property are required to lodge an objection with the County Secretary. The objection must be done on the prescribed form on or before the 18th June 2021 upon payment of a non-refundable fee of Kenya Shillings five hundred (KShs. 500).

The draft roll can also be accessed online and via https://valuation.nairobi.go.ke/ and aggrieved persons can lodge objections online.

Valuation is a public legal document that consists of property information of all ratable properties and exempted properties within the boundaries of a rating authority produced according to legislation.

Land rates, which is a form of land taxation, are based on the market value of land, which requires revision on regular basis, with the law providing for ten (10) years. Nairobi county has not prepared the Valuation Roll regularly as required by law, with the Roll in use currently having been done in 1980.

The new draft valuation roll proposes the new rates to be based between 0.1 and 0.115 percent of the current value of undeveloped land, setting the stage for costly levies.

Currently, property owners pay land rates at 25 percent of the unimproved site value based on the 1980 valuation roll. This means property owners will start paying higher rates compared to the current ones once the new valuation roll comes into effect.

The valuation roll has been tabled before the Nairobi County Assembly on the 15th January 2021.

For any further queries kindly reach out to us via rbf@cmadvocates.com

Related blogs & news

Change of Era as Service of Court Summons can now be effected through Mobile Messaging & E-Mail

The Civil Procedure Rules have been amended by the enactment of the Civil Procedure (Amendment) Rules, 2020 contained in Legal Notice No.22 in Kenya Gazette Supplement No. 11 dated 26th February 2020...

Civil Procedure Rules

The Civil Procedure Rules have been amended by the enactment of the Civil Procedure (Amendment) Rules, 2020 contained in Legal Notice No.22 in Kenya Gazette Supplement No. 11 dated 26th February 2020 ...

Share this blogLinkedIn Twitter Facebook Print