Labour Relations and Immigration Law Advisory

Obtaining Permanent Residency in Kenya

Be informed on what it takes to obtain permanent residency in Kenya

We are dedicated to providing top-quality legal representation to clients in a variety of areas, including criminal defense, family law, Asset Tracing & Recovery and many more. Our advocates have extensive experience and are committed to fighting for the best possible outcome for our clients. We prioritize communication and work closely with our clients to understand their unique needs and goals.

We have a huge experience and expertise in the field of bribery and corruption including, inter alia, bribery, corruption, money laundering, tax evasion, falsified accounting, insider dealing, abuse of office as well as extradition proceedings.

Our team includes specialists with experience in forensic investigative techniques, fraud detection and deterrence, white-collar crimes, and public and private law enforcement work.

We are well versed in handling diverse legal and commercial matters related to aviation including litigation, employment contracts, passenger claims, baggage and freight claims and other related matters.

Our clients include private companies, public listed companies, funds, investors and government institutions

CM Advocates LLP (CM Advocates) is devoted to assisting our clients’ communities by meeting the legal, regulatory and governance needs of charities and non-for-profit entities.

Commercial law which is an omnibus phrase for a range of legal services designed to support businesses in making money from their products and services, is indispensable in everyday business activities.

Our firm walks with you in your construction journey from conception, design and planning, project procurement, project finance, project implementation, operation and maintenance

We specialize in the registration of various business entities including public and private companies, foreign corporation branch/liaison offices, business names and not-for-profit organizations including trusts, NGOs, societies and foundations.

We can advise our clients at every stage of the data lifecycle

One of the firm’s most vibrant practice area is Debt Recovery, Restructuring and Insolvency that the firm offers its corporate clients especially banks, microfinance institutions and companies.

The firm has the legal expertise, capability and commitment to find quick creative and cost effective solutions for our clients in Tribunals, Commissions and any quasi-judicial bodies and arbitration venues.

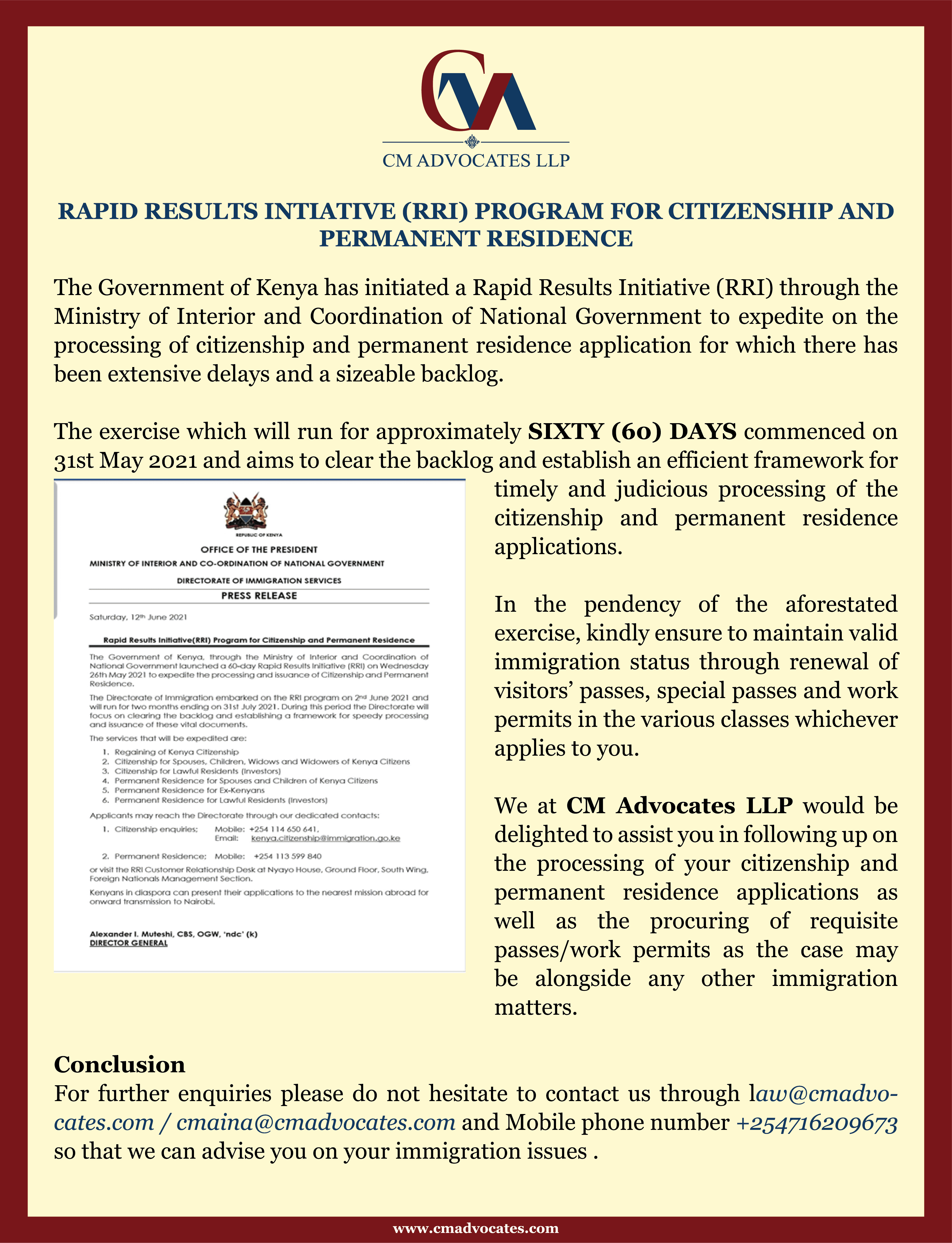

CM Advocates’ Immigration Advisory team represents businesses, organizations, and individuals from around the world on a wide range of immigration matters and visa needs.

Be informed on what it takes to obtain permanent residency in Kenya

Rapid results initiative RRI program for citizenship and permanent residence

A construction work agreement is an important document in construction and construction management p...

Skip to contentHomeAbout UsInsightsServicesContactAccessibility